2024

Can I Earn More On Deposit Than From Stocks And Shares Investments?

Mark Wigginton / 0 Comments /CAN I EARN MORE ON DEPOSIT THAN FROM STOCKS AND SHARES INVESTMENTS?

Understandably, people have been asking about whether to switch investments out of underperforming mainline stocks and shares funds into bank deposits, which have been paying more interest than for a decade.

There are three important numbers to weigh up in answer to this question:

- Interest rates and their likely future direction;

- Inflation and its trend;

- Stockmarkets and bond markets and their likely future returns.

None of these are certain and they all carry some level of risk (even a relatively stable 3% earned on deposit is whittled away in value if inflation is at 4%).

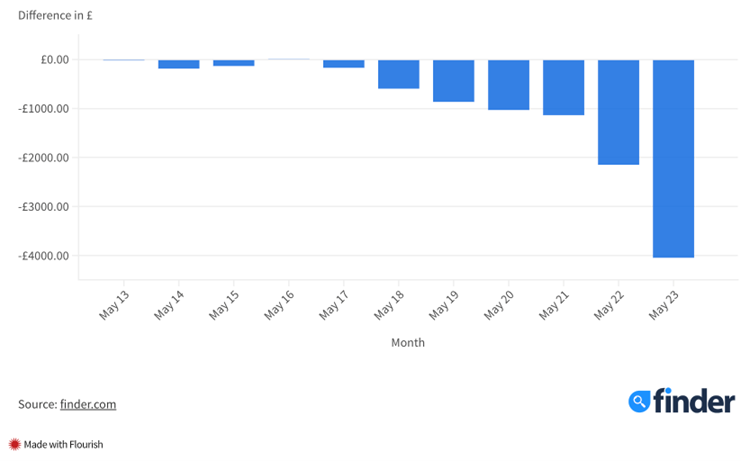

Inflation vs savings rates since 2013

The average UK savings account lost £4,047 in real terms over 10 years

(Difference between savings in line with inflation and savings with real interest rates)

By contrast, investments have beaten inflation over the long term, even though bond markets have fallen recently.

Help me to decide, Tears for Fears (Everyone Wants to Rule the World, 1985)

How does one decide?

We have always recommended “Two pots”.

Keep sufficient liquidity in the bank for short term needs – that’s one pot; and invest surplus funds for longer term – that’s the second pot.

This may or may not produce the best overall returns in the long run, but does give you peace of mind for the near future and potential for good returns as you look further ahead.

No comments so far!

Leave a Comment