2024

An Extraordinary (2) Year(s) For Investors and everyone else too…

Mark Wigginton / 0 Comments /Nothing changes and nothing stays the same, Moody Blues, 1999

The eagle-eyed among you might notice that there are only two subtle changes to the above heading from our last client newsletter. This is not because there has been nothing to say, even though it has been a while since we last wrote. As it happens, many of the conditions that prevailed at the end of 2022 have largely persisted:

- Putin’s Russia is still waging war with Ukraine.

- Energy prices are still high.

- The cost-of-living crisis has continued.

- The rate of inflation has stayed relatively high.

- Interest rates have risen although they too are probably heading down again.

- Shares have produced relatively poor returns.

- Cash deposits have benefited from relatively high rates of interest, but have still been lower than inflation.

- Government and corporate bond values have fallen hugely from their height at the end of 2021 because of those last two factors. This has punished those investors who tend to take a lower-risk approach (typically they will choose an investment portfolio with a higher ratio of bonds to shares).

As we highlighted in our last newsletter, our suggested response to the ensuing bad news in investment markets largely depends on your individual circumstances, so, during this time, we have thrown our energies into helping you to navigate the peculiar challenges of these times, given your own objectives. We have also continued to review our advice and investment strategies to ensure that these continue to be robust and sustainable.

Radical uncertainties – I don’t know which way to go, Eric Clapton (Rush soundtrack 1991)

Of course, many things have also changed since we last spoke. To mention a few:

- The rate of inflation, whilst still high, has recently fallen.

- Interest rates have – for the time being – stopped rising and may be on their way down, slowly.

- Share returns have improved.

- Bond returns have also been in positive territory.

- New regional conflicts – such as the war in Gaza & the wider Middle East – have also emerged across the world.

- Artificial Intelligence (or ‘AI’) has seemingly overnight become a buzzword for emerging computer machine-learning technology, appearing in everything from our mobile phones to web browsers and telephone call centres.

- The UK seems to be on course for a general election this year and in the “Year of the Vote” will be joined by some 1.5 billion people also heading to the polls in Russia, Ukraine, USA, India and Bangladesh and elsewhere.

Whilst there is good and bad in these factors, all of them are likely to have ramifications that cannot yet be fully known. This illustrates beautifully one of our key beliefs, which is that “Economic uncertainty is certain”.

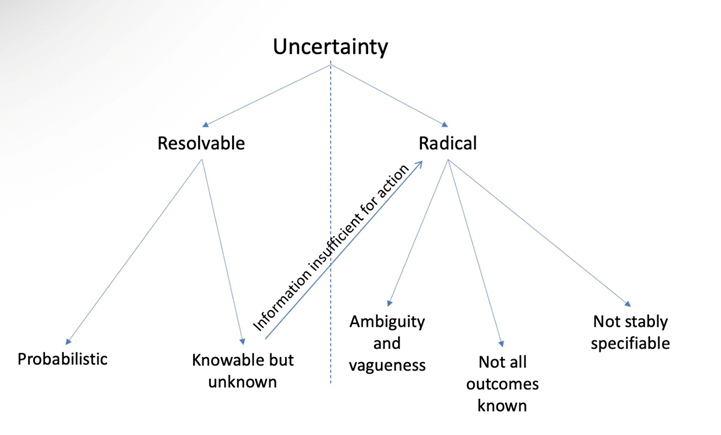

Professor John Kay (co-author of Radical Uncertainty, with former Bank of England chairman Mervyn King) says that uncertainty comes from our imperfect knowledge of the past, present and future. He explains that uncertainty can be good or bad. Some uncertainties are resolvable by acquiring more knowledge to specify them, or because they conform to probabilistic models which allow us to make predictions… whereas other more radical uncertainties, because of their complexity or instability, can never be specified or predicted.

Given the complexity of the world, we cannot entirely eliminate the risk of a bad outcome, so the task of financial planning becomes the task of managing risks. John Kay suggests that this can be done in a couple of ways:

- By recognising that risks are specific to your own situation, and adopting strategies which reflect this;

- By embracing uncertainty – this means using diversification as a means of meeting your future needs, plus – where appropriate – backing this up with insurance to cover the risks of more radical uncertainties.

Perhaps this sounds familiar. It should do because it echoes our approach when advising you. Your financial reviews with us will continue to be very important in helping you decide “which way to go” to manage risks and to achieve your financial objectives. For example, at these reviews we will discuss how to manage and keep in balance your short-term need for liquidity with your longer-term need to ensure that your savings keep pace with inflation and do not run out. We will also have conversations with you about the risks of different courses of action and will continue to maintain and develop the diverse evidence-based models which underpin our investment advice to you.

You may wish to re-assess your personal strategy, the one we have developed with you over the years. Do get in touch if so – that’s what we are here for.

No comments so far!

Leave a Comment